I got an email notification last week for a new episode of

Bishop Barron’s Word on Fire podcast asking Is There a Catholic Antidote to the Crisis in Higher Education

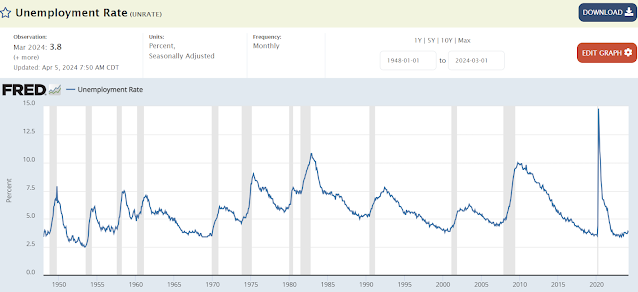

“According to Fortune magazine, overall undergraduate

enrollment experienced the steepest rate of decline on record from

2019 to 2022, and it has only worsened since then.

There are several explanations, but one cause is entirely self-imposed:

most universities and colleges have now replaced education with ideology,

subverting the search for truth with political indoctrination.

In this episode of The Word on Fire Show,

Bishop Barron and Matthew Petrusek, Senior Director of the Word on Fire Institute,

discuss the ideological takeover of higher education and how the Catholic

conception of the university can help provide an antidote.”

I’m afraid that before providing an antidote they should put

some more work into their diagnosis. The episode does not provide any evidence

that “most universities and colleges have now replaced education with ideology,

subverting the truth with political indoctrination.”

What it does provide are

some references to the recent congressional testimony of some Ivy League

presidents and some vague allusions to wokeness. Given the argument that students are not attending college

because faculty are pressing a certain ideology and the Bishop’s example of the

prevalence of this ideolog at Ivy League schools they must be at the forefront

of the decline in enrollment. Anyone who knows anything about higher education

knows that nothing is further from the truth. Ivy League schools are

seeing record numbers of applications, leading to record low acceptance rates. They

are doing just fine.

The schools that are seeing declining enrollments are less prestigious

schools, especially smaller regional schools. The students who aren’t going don't express concerns about ideology; they are concerned about stress and mental health, the

rate of return on their investment (which evidence still indicates is high),

and their ability to pay. See, for instance, Exploring

the Exodus from Higher Education

People will always be able to find anecdotes about some

college course that they don’t like or some statement by an administrator that

sounds preposterous, but as someone who has taught in colleges for more than 30

years, I just don’t see the world that Bishop Barron and other purveyors of the

wokeness boogeyman want people to believe in. The most popular major in the United

States is business, accounting for around 1 in 5 undergrads. Some of the other

top majors are engineering, computer science, and nursing. Are we seriously

to believe that these schools are not in fact preparing people to be managers,

accountants, engineers, computer programmers, data scientists, nurses, teachers, etc. but

are instead just indoctrinating them in a political ideology?

If Bishop Barron really wants to play a positive role in

higher education he should try to do better than this.